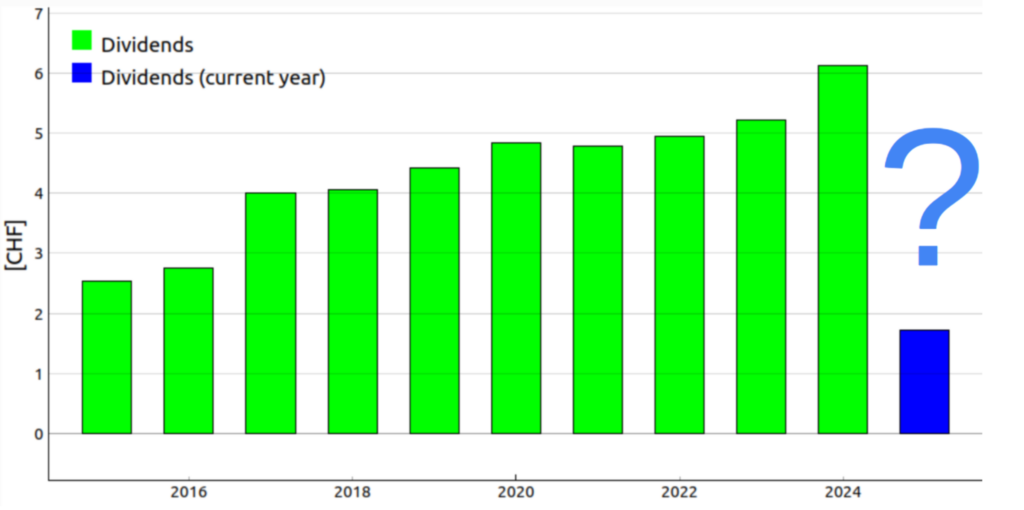

One year ago I estimated the dividend payout for 2023 for the ETF iShares CHDVD in 2024 in this blog. On the one hand it is a good point to look back and check how well the estimate has forecasted the real outcome. On the other hand, it is a good time to make an estimate for 2025.

Estimate vs true pay-out in 2024

The forecast for 2024 predicted a gross dividend per share including cost of 6.091 CHF Swiss Francs. In the end a gross dividend per share including costs of 6.12 CHF was recorded. This is a relative error of only 0.49%! This kind of proves that the estimation logic is more or less sound.

Estimate for 2025

To estimate the expected dividends paid-out the following numbers are required:

- Number of shares hold by the ETF for every holding at the holding’s ex-dividend date

- Expected dividend pay out per company

- Total number of outstanding ETF shares

- The cost per ETF share

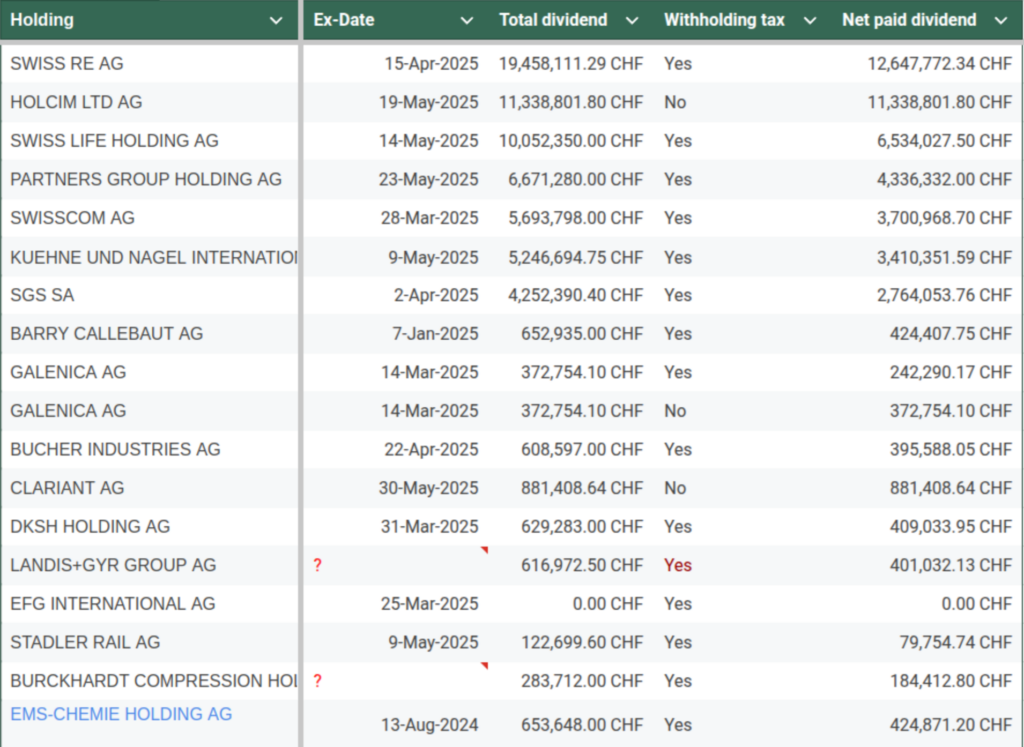

The number of shares hold by the ETF per company can be retrieved from a .csv holdings file on the iShares fund’s page. For this blog entry I downloaded the fund’s holding on March 26, 2025. Column H contains the number of shares per company hold by the fund. Please note since a re-constitution happened in March some constituents dropped out that had reached their ex-date prior to the re-constitution date while there were others that were added that had already not reached their ex-date. To account for this I also checked on all constituent on February 28, 2025. In the table I listed all holdings that potentially contributed to the dividend pay-out in 2024. I tried to find out the ex-date, the dividend/share and whether the whole amount is subject to withholding tax. Please treat these numbers with a grain of salt. It might be that some information was not available at the time. Also the total amount of paid dividends per holding might differ eventually compared to what you see in the table because the number of shares hold by the fund can change over time. Holdings in red have a significant uncertainty associated to one of their numbers. Below you can see that I have colorized one holding in blue. As you can see that holdings had their ex-date in 2024. I added them to this table because the ex-date happened after the last pay-out to the ETF holders in 2024 which was on July 18, 2024.

The number of outstanding ETF shares can be retrieved from the iShares fund’s Übersichtswebsite. At the time of writing it was 25’275’000 shares.

The cost per ETF is computed in the following way (It assumes a share price of 155.44 CHF):

iShares writes on the funds Übersichtswebsite that the Security Lending Return is about 0.01%. Hence, I assume:

I compute the net coste per share as:

To compute the gross dividend per ETF share excluding costs, I divided the all collected dividends from all holdings in the fund by the number of outstanding ETF shares:

To get the gross dividend per share including cost, I subtracted the net cost per ETF share:

The fund paid a total of 6.12 CHF dividends/share in 2025. Hence, an increased pay-out of 6.368 CHF/share would mean a 4.06% increase compared to 2024.

Is this increase realistic?

To answer the question whether the increase of 4.06% is realistic, it is worthwhile to check on the past dividend growth of this fund. In a July 2022 blog, I computed the compound annual growth rate (CAGR) for the year 2015 until 2022 to be around 9.97%. Three years later we can re-compute the CAGR for the years 2015 until 2025 using the estimated dividend pay-out of 6.368 CHF in 2024:

This 9.63% CAGR appears inline with the 9.97% what we computed in 2022.