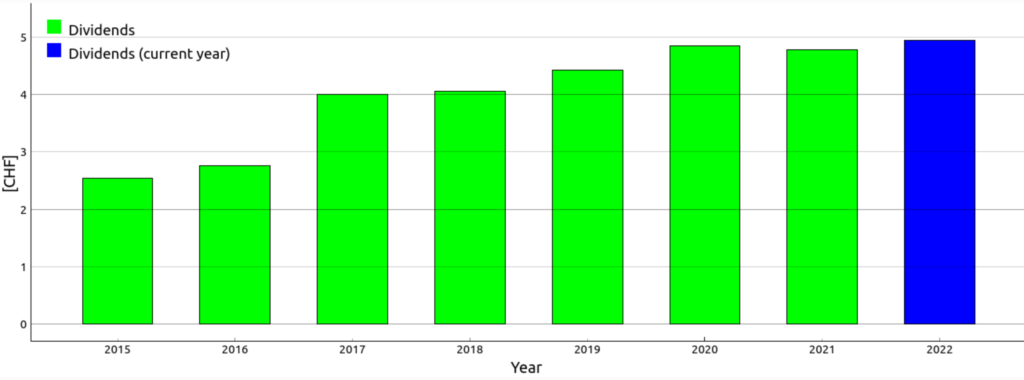

I quite like the ETF from iShares called Swiss Dividend ETF as I have written in my first blog post one year ago here. Since I am in the process of predicting the inflow from cash of dividends I was also curious to see how the the dividend of this ETF evolved over time. iShares lists this fund’s distribution on their Übersichtswebsite. We can see that the fund usually distributes the dividend in the months between March and July. This is not surprising as the fund consists only of Swiss stocks that normally (but not always) pay their dividends in spring. Looking at the preceding weeks it seems like the last payment for 2022 was made on 21 July 2022. I extracted the listed distribution on the iShares website and put them into a .json file on Github here. Please note, I tried my best to copy the data but cannot guarantee that it is completely correct. Below I depict the distribution per share per year of this fund. The bar chart only starts with the year 2015, since the fund was introduced in 2014. I use the compound annual growth rate formula to compute the dividend growth for this period.

The fund paid 2.54 CHF/per share in the year 2015 and now in 2022 it paid 4.94 CHF/per share.

Hence, the annual growth rate (CAGR) for this period is:

I.e. if my numbers are correct the compound annual dividend growth rate was 9.97%. In my opinion this number is quite satisfying. On the other hand, we also see that in the year 2021 the distribution was reduced from 4.84 CHF/per share to 4.78 CHF/per share due to the negative influence of the Corona pandemic. Overall, I personally think if the growth rate of 9.97% is sustainable the investment in this fund can be considered a good decision.