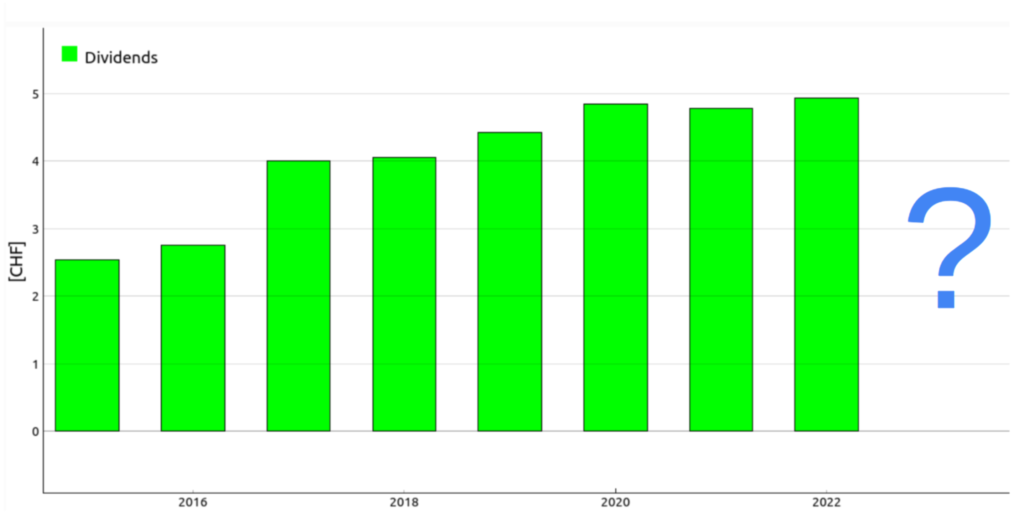

So what dividend payout can we expect from the ETF CHDVD in 2023? Last July I reported about the dividend growth of the ETF CHDVD which track the SPI Select Dividend 20 from SIX in this blog entry. I reported that this ETF paid out 4.94 CHF/share in 2022. iShares has announced a total of 2 CHF/share so far in 2023. Since I am really curious, I tried to estimate what will be the final amount of paid-out dividends for 2023. Please note, this is only my personal estimate and could well be wrong. Hence, please do not base your investment decision on this very estimation but do your own due diligence.

There are uncertainties regarding effectively paid dividends of each company because some are not yet approved by shareholders or not even announced. Also the cost for the fund that are deducted depends on the share price which can vary over time. Additionally, the final amount also depends on how many shares of a company that has not yet paid out its dividend are going to be added to the ETF.

Estimation process

To estimate the expected dividends paid-out the following numbers are required:

- Number of shares hold by the ETF for every holding at the holding’s ex-dividend date

- Expected dividend pay out per company

- Total number of outstanding ETF shares

- The cost per ETF share

The number of shares hold by the ETF per company can be retrieved from a .csv holdings file on the iShares fund’s page. For this blog entry I downloaded the fund’s holding on March 30, 2023. Column H contains the number of shares per company hold by the fund.

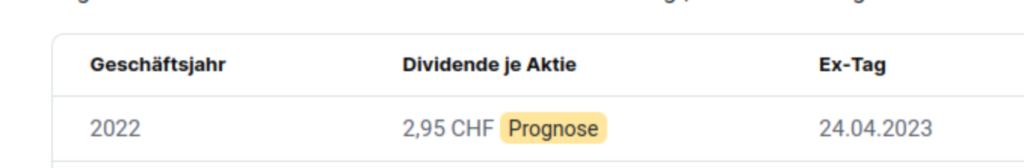

I used the website aktien.guide to retrieve the expected dividend pay out per company. E.g. for Nestle:

The number of outstanding ETF shares can be retrieved from the iShares fund’s website:

The cost per ETF is computed in the following way:

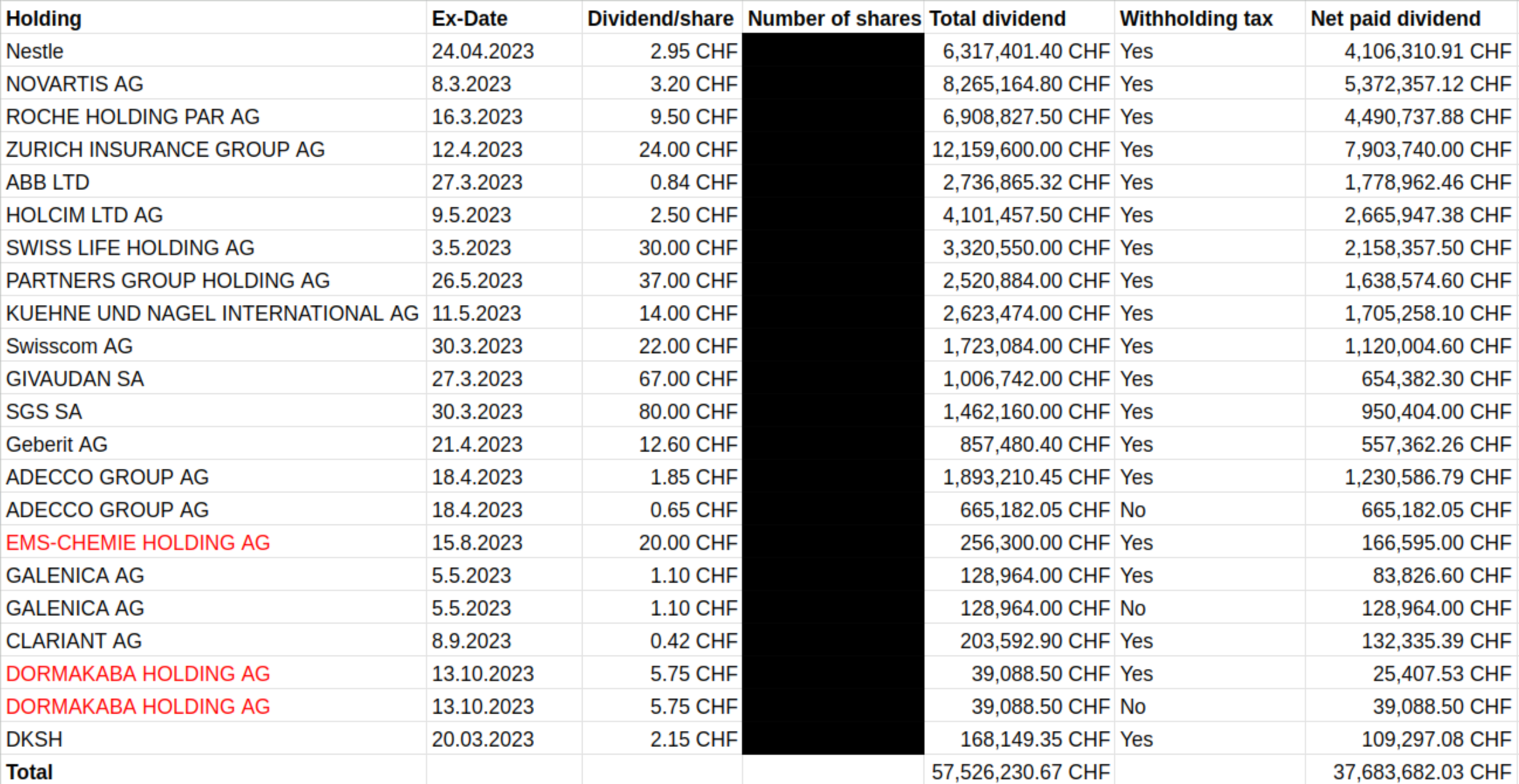

In the table below I listed all the relevant companies, their dividend per share and the respective dividend ex-dates. Also I added a column that states whether the taxes are withhold or not. Normally, the Swiss tax authorities withheld 35% of the dividend. This amount can later be claimed by declaring the whole dividend in your tax declaration form provided that you fill out a Swiss tax form. I marked those companies in red for which I am really not clear whether the dividend/share is accurate because it has not been declared yet.

To compute the gross dividend per ETF share excluding costs, I dividend the total dividend amount from all companies in the fund by the number of outstanding ETF shares:

To get the gross dividend per share including cost, I subtracted the cost per ETF share:

Since the ETF distributed 4.94 CHF/share in 2022, I can note that the gross dividend payout for CHDVD including costs for 2023 is predicated to grow by 0.27 CHF/share i.e. by 5.47%. Again I re-iterate that this is only an estimation. Only time will tell how close this forecast estimated the true payout.